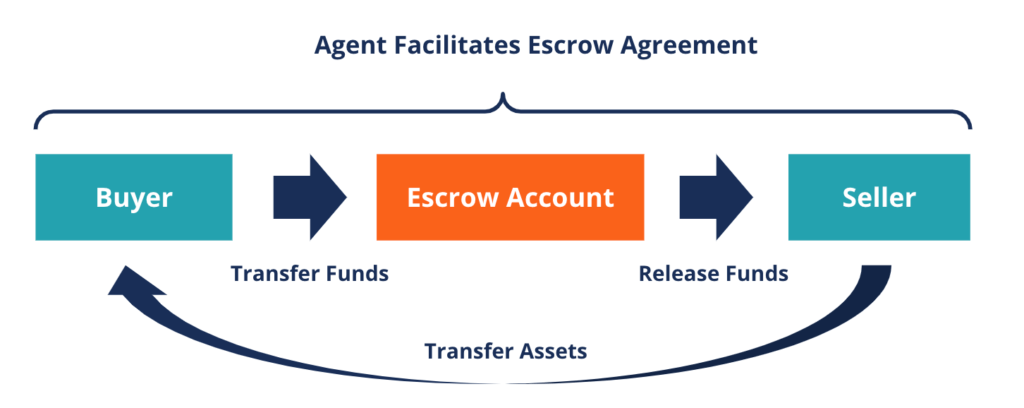

An escrow agreement refers to a contract that outlines the terms and conditions of a transaction for something of value – such as a bond, deed, or asset – which is held by a third party until all conditions have been met. The terms and conditions outlined in the agreement will have been agreed to by the transacting parties before escrow.

The independent third party involved, called an escrow agent, is responsible for holding documents and regulating the payment of funds required in the transaction. The third party then hands over the retained asset to the party entitled to receive it once all terms have been fulfilled.

Escrows are useful for transactions where a large amount of money is involved, and several obligations must be fulfilled before payment is released. For example, escrow is used in real estate for the sale and purchase of a property.

It is also often used in mergers and acquisitions and other corporate transactions. In the legal system, they can be used to distribute money in a class action for settlements.

Escrow agreements are employed in a large number of private companies and subsidiary acquisitions made by publicly-traded firms. It is used largely to protect the buyer from risks associated with the acquisition, especially when the seller or target company has concerns relating to credit risk.

The bidder uses the contracts by setting aside a percentage of the total purchase price, which is held in escrow for a negotiated period of time after the completion of the acquisition. Bidders will receive the escrow funds back if the target company fails to meet certain terms in the agreement or hid critical information before the sale.

Hence, escrow contracts act as a warranty offered by the seller to protect against common information asymmetry problems and acquisition-related risk experienced by bidding companies.

Escrow can also be used in the sale and transfer of shares in the stock market. Companies put shares into an escrow account for different reasons. If shares are used as part of a payment in a merger with another company, the buyer company will put shares into escrow until the deal has been completed.

Shares issued to employees as a benefit may be restricted to the employee for a certain period. During such a period, employees cannot trade the stock on the market, so the shares sit in escrow.

In real estate, escrow is used to facilitate the closing of a real estate transaction. The escrow company creates a short-term account to hold the money and all documents related to the transaction rather than letting the buyer and seller deal directly with each other.

The mediating company then distributes all funds and documents to their rightful owners once the agreement has been fulfilled on both sides.

In the judicial context, escrow funds are commonly used in cash settlements for a class action. Usually, the defendant will pay the total amount of the settlement to a specified escrow fund. The fund will then distribute money to the individual plaintiffs or for any other specified use.

Before any money or property exchanges hands in a two-party transaction, escrow agents ensure that both sides follow their promised agreements. The agent acts to protect both buyers and sellers from potential defaults or fraud. In particular, escrow services ensure that the buyer does not bear the same risk as in open trade.

Escrow agreements are provided by independent escrow services whose trustworthiness must be assessed carefully. The agent is to be trusted with the holding and releasing of funds, which is a large responsibility and a noteworthy risk to both buyers and sellers.

Due to several instances of fraud in the past, users should conduct proper due diligence into escrow services to protect against any wrongdoing.

In order to help you become a world-class financial analyst and advance your career to your fullest potential, these additional resources will be very helpful:

Gain in-demand industry knowledge and hands-on practice that will help you stand out from the competition and become a world-class financial analyst.